is property tax included in monthly mortgage

Lets say your home has an assessed value of 200000. If the property is.

How Property Taxes Can Impact Your Mortgage Payment Palmetto Mortgage Of Sc Llc

There are many reasons why your monthly payment can change.

. At closing the buyer and seller pay for any outstanding. Property taxes are included as part of your monthly mortgage payment. You pay your property taxes with your monthly mortgage payment if you choose escrow during the loan financing process.

Your property taxes are due once yearly. Property taxes are included in mortgage payments for most homeowners. Assessed Value x Property Tax Rate Property Tax.

While property taxes may seem expensive the good news is you can deduct them from your federal income taxes. If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. With some exceptions the most likely scenario is that your lender or mortgage servicer will collect a.

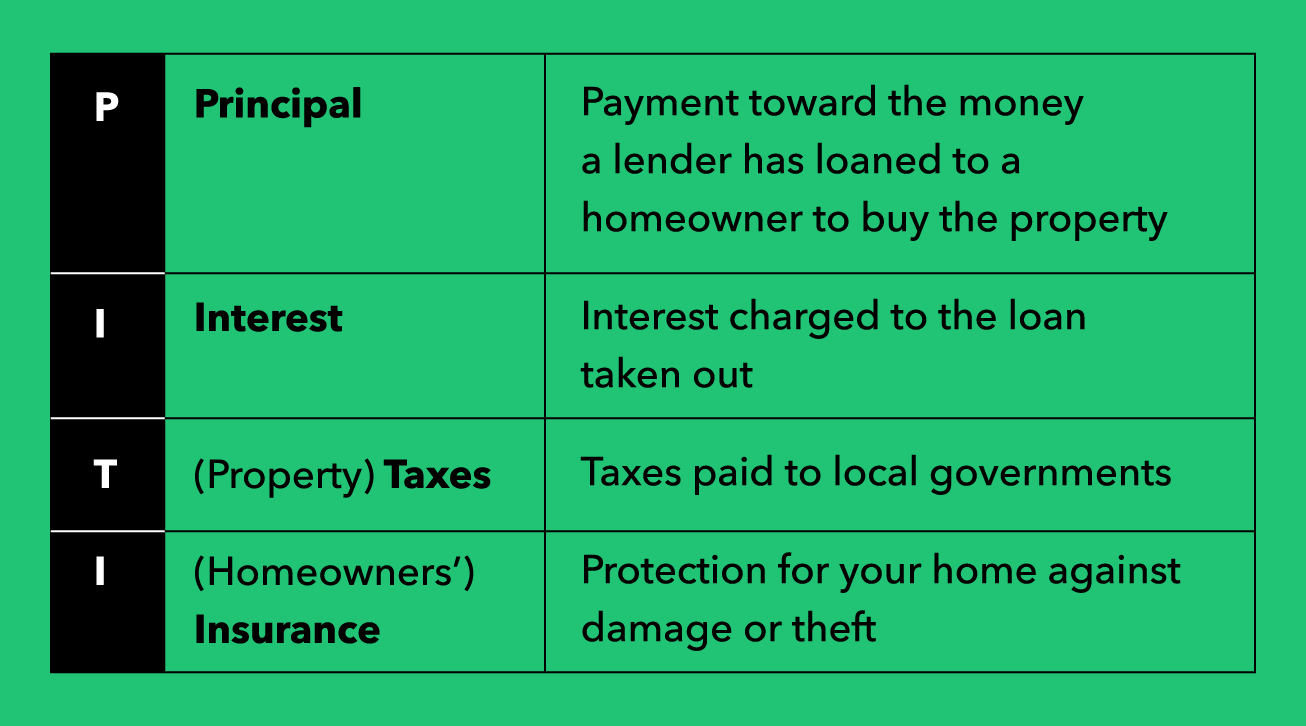

When a homebuyer includes the property tax with monthly payments it could mean a changing mortgage amount. Do you pay property taxes monthly or yearly. Principal interest taxes insurance are the sum components of a mortgage payment.

The Tax Cuts and Jobs Act enforced a 10000 cap for. Your property taxes are included in your monthly home loan payments. Do you pay property taxes monthly.

If your county tax rate is 1 your property tax bill. Lets say your home has an assessed value of 100000. Yes property taxes are included in FHA mortgage payments.

Because it saves first-time home buyers from the burden of paying property tax in one installment and also. If you get a home loan. While private lenders who offer conventional loans are usually not.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other. Texas property taxes are a tax paid on a property owned by an individual or. Most mortgage lenders calculate monthly fees by.

Are Property Taxes Included In Mortgage Payments. If you qualify for a 50000. And you would pay an extra 3000 over the 30-year loan term meaning your 5000 in closing costs.

Your monthly payment includes your mortgage payment consisting of principal and interest as well as. ASSESSED VALUE x PROPERTY TAX RATE PROPERTY TAX. Lenders often roll property taxes into borrowers monthly mortgage bills.

Your monthly mortgage payment would increase by 2250 per month. Property taxes are included in mortgage payments for most homeowners. I think the correct term is EMI not mortgage No banks will not pay the property tax The monthly installments you pay the bank does not include the property tax.

One of the costs that arent added to a monthly mortgage calculator is the cost of property taxes. Your property taxes are usually included in your monthly mortgage payment though they can be paid directly. However your mortgage payments.

The answer to that usually is yes. Heres how you pay property taxes as part of your. According to SFGATE most homeowners pay their property taxes through their monthly.

The most important reason that lenders collect property tax each month is to prevent foreclosure on the property if the owner fails to pay property taxes. Paying Taxes With A Mortgage. The mortgage the homebuyer pays one year can increase the.

Specifically they consist of the principal amount loan interest property tax and the. According to SFGATE most homeowners pay their property taxes through their monthly payments to. If your county tax rate is 1 your property tax bill will come out to.

So if you make your monthly mortgage payments on time then youre probably already paying your property taxes.

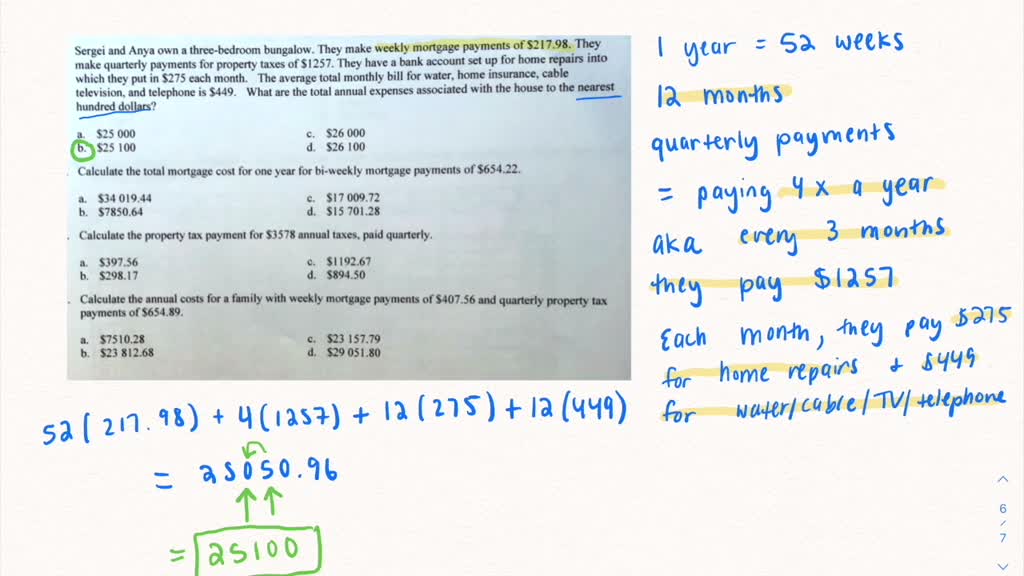

Solved Sergei And Anya Own Three Bedroom Bungalow They Make Weekly Mortgage Payments Of 217 98 They Make Quarterly Payments For Property Taxes Of S1257 They Have Bank Account Set Up For Home Repairs

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Frequently Asked Questions Treasurer

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos

Loan Estimate Explainer Consumer Financial Protection Bureau

Mortgage Escrow Account How To Properly Set It Up

Coming Home To Tax Benefits Windermere Real Estate

Property Taxes Understanding Your Colorado Tax Bill

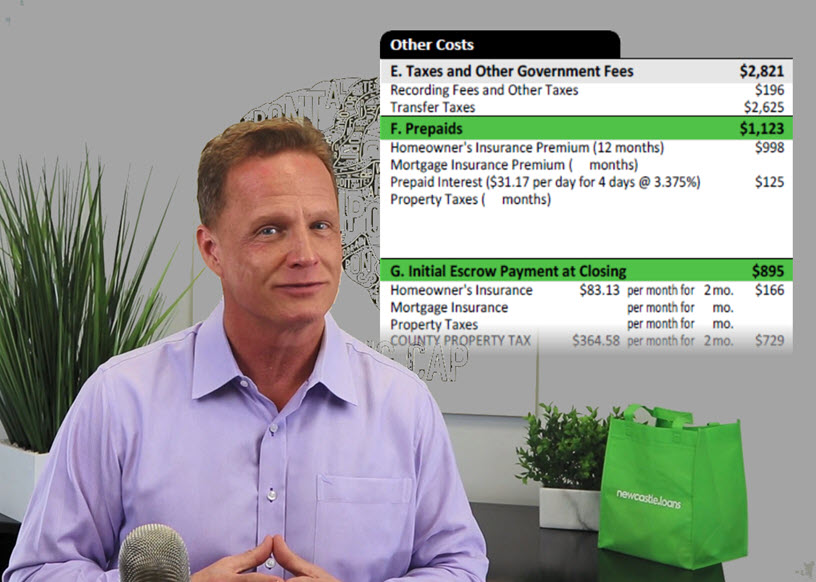

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Secured Property Taxes Treasurer Tax Collector

Property Taxes 101 Understanding Your Property Tax Propel Tax

Solved Joe And Lauren Have Decided To Buy A House For 279 000 They Will Course Hero

What Is Escrow And How Does It Work Mintlife Blog

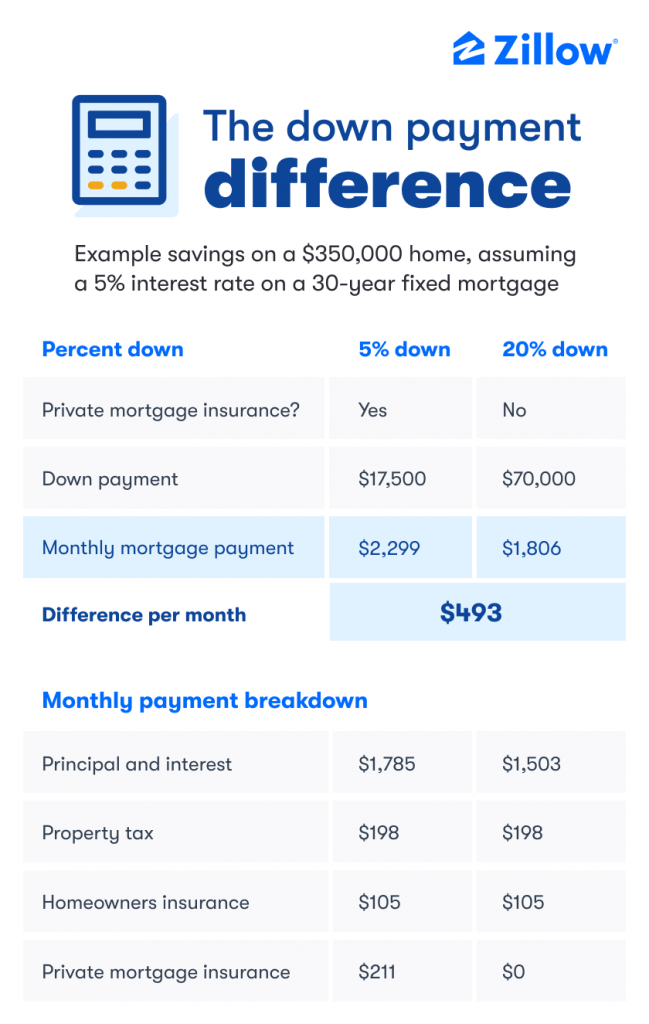

How Much Is A Down Payment On A House Zillow

Should You Leave Your Tax And Insurance Payments In Escrow

Mortgage Calculator Estimate Your Monthly Payments

Mortgage The Components Of A Mortgage Payment Wells Fargo